News

Latest News & Updates

New Email Address to Contact Us Via

18th December 2018

Please note that as of now we have a new email address for you to use to contact us via. This replaces the previous BTconnect one:

Could you please update your records, thank you.

Base Rate Increase Announced

2nd November 2017

Bank of England have today Increased the BOE base rate from 0.25% to 0.50%, this is the first increase for over a decade.

The vote was 7 in favour of an increase and 2 in favour of keeping interest rate unchanged. Based on comments made by Mr Carney, he has indicated there are likely to be 2 further increases over the next 3 years. If that proved to be the case, and each increase was 0.25%, the BOE base rate would only be 1% at the end of the decade. Time will tell however.

Hung Parliament - Likely Brexit Outcome

10th June 2017

- The Hung parliament is widely seen as being likely to result in a softer Brexit outcome due to the Coalition. One of the UK’s best known and highly respected fund managers has stated he is even more positive about getting good investment returns as a result of the election outcome. Sterling has proved to be resilient in the short term, FTSE increased by around 1% on Friday 9th June 2017, the day after the election, as 70% of the FTSE 100 companies revenue comes from overseas and the fall in Sterling, although relatively small, is good news for relevant companies. The UK Mid 250, although more domestic in business terms, also does around 50% of business overseas, and although the Mid250 index fell the day after the election, the fall was very modest which is god news as the Mid 250 index has risen quite a lot over the past few weeks/months.

So, the outcome of the UK General election is not being seen as resulting in UK Equities looking negative by and large in the short term, and ongoing volatility is likely to be high, but was the likely to be the case during the Brexit negotiations anyway, election or not.

UK Inflation Above Government Target

22nd March 2017

- UK Inflation figures see inflation at 2.3% which is above the government target of 2%. This is the first time inflation has been above the government target since late 2013.

Budget Highlights Summary

9th March 2017

- Higher National Insurance Contributions for many Self Employed but not all. For a Self Employed person with net profit in excess of £16,250.00, they will end up paying higher National Insurance contributions but those with net Profits of less than £16,250 are likely to pay less. Higher Earners will see the biggest increases and a figure used as a kind of average is estimated to be an increase of around 0.60p per week.

- Tax Free Dividend Allowance to reduce from £5,000 to £2,000 in the 2018/19 tax year. Many Company Directors receive part of their remuneration by receiving Dividends and this change will result in more tax being paid where the Dividends exceed £2,000 in the Relevant tax years. This would of course be a double negative if a husband and wife were both Company Directors and receiving dividends of say £5,000.00 each, and £3,000 each would no longer be tax free.

- Tax Free Personal Allowance will increase from £11,000 to £11,500 for the 2017/18 Tax Year

- The higher rate tax threshold to increase to £45,000 (the equivalent threshold in Scotland is £43,000) from 6th April 2017.

- A Small increase in the Capital Gains Tax Allowance to £11,300 from 6th April 2017.

- Corporation tax to reduce to reduce to 19% from 6th April 2017 and to reduce to 17% for the 2020/21 tax Year

- Pensions – Money Purchase Annual Allowance will reduce from £10,000 to £4,000.00. This applies where people have taken certain pension benefits resulting in the Annual Allowance being reduced from qualifying earnings Capped at £40,000 being previously reduced to £10,000 maximum and now being reduced to £4,000 from April 6th 2017.

Budget Highlights Summary Update

15th March 2017

- The National Insurance changes announced in last weeks budget have now been scrapped by the Chancellor and will not be implemented. This is of course a u-turn and due to the criticism as a result of the General Election pledge that National Insurance rates would not be increased.

Buy-to-Let Property Purchases Slow Down

9th June 2016

Higher Stamp Duty on second properties has led to a slowdown in 'Buy-to-Let' property purchases and resulting lower mortgage volumes for Buy-to-Let products. Santander have announced they are to reduce interest rates on certain Buy-to-Let mortgage products obviously aimed at the remortgage market. This could be good news if this trend is followed by other lenders in the Buy To Let Mortgage market.

Mortgage News

9th May 2016

Some lenders are increasing the age at which mortgages need to be repaid by for New Applicants. The Nationwide have just extended the maximum age at the end of the mortgage term from 75 to 85 and the Halifax have increased to age 80 at the end of the mortgage term. Pension income in retirement is likely to be a key underwriting consideration. The main advantage of the older age is to allow a longer mortgage term in some cases resulting in lower and more affordable monthly repayments. Care needs to be taken however when deciding on extending the mortgage into retirement.

Stamp Duty Set To Increase

9th March 2016

Buy To Let Stamp Duty Land Tax from 1st April 2016 will be increased as follows:

Stamp Duty is charged at the above rates for each band of value. Example, a purchase from 1st April 2016 of £225,000 would result in 3% Stamp Duty of £3,750 on the first £125,000 and £5,000 on the next £100,000 making a total of £8,750 which equates to 3.778% Stamp Duty in total. On the present basis, which ends on 31.03.2016, the Stamp Duty would have been £2,000.00.

Property’s purchased for less than £40,000 do not pay Stamp Duty.

EU Referendum Date Has Been Announced

24th February 2016

Prime Minister David Cameron has today announced that the EU Referendum will be on 23rd June 2016. Mr Cameron has stated that he is in favour of remaining in a Reformed European Union. He considers, for a number of different reasons, that the UK will be safer in the future as a result of remaining in the EU rather than leaving.

2015 Autumn Statement Highlights

27th November 2015

- Stamp Duty for Buy To Let Property Purchase Increase

From April 6th 2016 an extra 3% Stamp Duty will be charged where a property is being purchased to Let Out, this is in addition to the normal Stamp Duty. As an example, a property purchased for £200,000 would have to pay an additional £6000 in Stamp Duty. Different rules may apply outside England. - Single State Pension

The new Single State Pension for people retiring after 6th April 2016 is £155.65 per week, £8,093 per annum subject to qualifying for the full pension. - ISA Contribution Limits

ISA contribution limits for the 2016/17 tax year is staying at the present limit of £15,240.00. The contribution limits for Junior ISA are also unchanged at £4,080.00.

National Savings & Investments to reduce interest rate for Direct Cash ISA

21st September 2015

National Savings & Investments to reduce interest rate for Direct Cash ISA. The interest rate is to be reduced from 1.5% to 1.25% on 16.11.2015 and account holders will be provided with 60 days notice in respect of the interest rate change.

Bank of England Keep Interest Rates at 0.5%

6th August 2015

The Bank of England today kept interest rates at 0.5% which was not a surprise. What was slightly unexpected was that only one member of the committee, Ian McCafferty, voted in favour of a rate rise, it had been largely expected that 2 or more members of the committee may have voted for a rise. Whether this suggests it will be slightly longer than anticipated before interest rates increase, time will tell.

Inheritance Tax Limits Expected to Increase

6th July 2015

Next week’s budget, the first since the General Election, is expected to see Inheritance Tax Limits increase to £1million per person. This will be very good news for many people.

Financial Services Compensation Scheme reduces from £85,000 to £75,000 per person

3rd July 2015

The Financial Services Compensation Scheme (FSCS) has been reduced from £85,000 per person to £75,000 per person effective from 03.07.2015. The existing level of deposit protection of £85,000 will however continue to apply until 31.12.2015 for depositors currently covered by the FSCS.

Premium Bonds To Stop Being Available From The Post Office

1st July 2015

From the 1st of August 2015, Premium Bonds can no longer be purchased from Post Office. The other purchase options such as online

and post will continue.

Pensions: Lifetime Allowance Changes

25th April 2015

The lifetime allowance allowance is set to reduce to £1m from 6th April 2016. Charges will apply to members who have benefits in excess of the lifetime allowance when benefits are taken. Download our data sheet

on historic allowance figures and to see how allowance charges can apply.

New Home Counties Financial Services Website Launches

22nd April 2015

We're delighted to announce the launch of our new website which has been re-designed by Digity

on a completely new platform. This new technology is 'responsive' meaning our content is now re-sized depending on whether you are using a mobile, tablet or pc to view it. We hope that this will make us even more accessible to clients going forward.

Aviva Acquisition of Friends Life Approved after merger agreed by AVIVA and Friends Life Shareholders

27th March 2015

Aviva’s UK and Ireland life chief executive David Barral will leave the group next month, after Friends Life shareholders approved the merger of the two providers.

Yesterday Friends Life shareholders approved the acquisition of the business by Aviva, 94% voting in favour, after Aviva shareholders approved their side of the deal earlier in the week.

Pension News From March 2015 Budget

25th March 2015

The Lifetime Pension Allowance is to be reduced from £1.25 million to £1 million from the 2016/17 tax year.

Care needs to be taken to avoid exceeding the Lifetime Allowance as this would result in Tax Penalty Charges being applied.

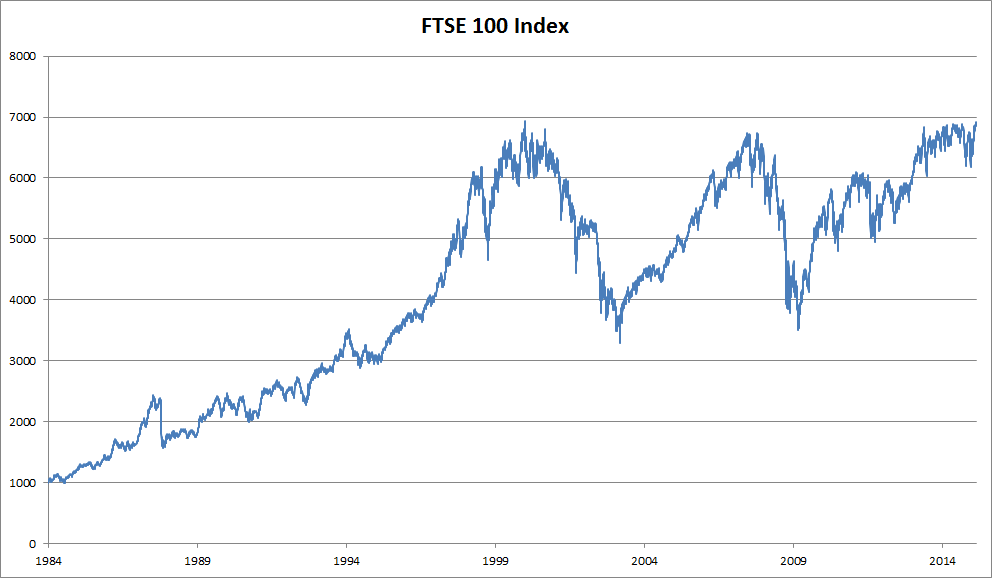

FTSE HISTORY IS MADE!

20th March 2015

FTSE Passes 7000 for the first time ever, on Friday 20th March 2015. How Long before 8000 is passed??

FTSE 100 Share Index Closes At New Record High

24th February 2015

The FTSE 100 closed at 6,949.63 on the 24th February 2015, beating the previous record close of 6,930.20 on 30th December 1999. Earlier in the day it hit a new interday high of 6,956.89 surpassing the previous interday high of 6,960.60 which was set on 30.12.1999.

Follow Us

Home Counties Financial Services

Bridge House, 18 Brockenhurst Road,

Ascot, SL5 9DL

t: 01344 870 338

© 2024

All Rights Reserved | Home Counties Financial Services

Home Counties Financial Services are authorised and regulated by the Financial Conduct Authority.

Number 181055